Serendipity stuck its nose in, as it so often does, and the following chart also popped up, in that way Google throws up things vaguely linked to what you search at times.

|

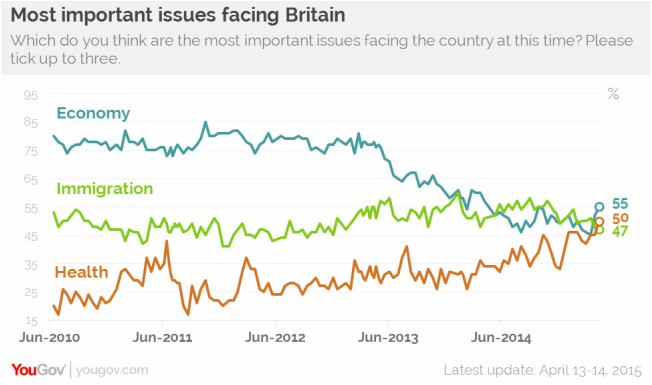

As a lecturer who, for his sins, gets to teach sampling and statistics I remain interested in the narrowness of the referendum vote. What is particularly interesting is that set of people who are undecided – as if often the case these fickle individuals can swing results. This led me to look back over a long set of data for the referendum to see if I could detect swings. The first chart is fairly self explanatory – the undecideds mostly swung toward leave. Serendipity stuck its nose in, as it so often does, and the following chart also popped up, in that way Google throws up things vaguely linked to what you search at times. This immediately caught my attention. There was a clear spike in attitudes on immigration that began to harden just as the referendum campaign kicked off last year. Again I looked for longer data.  It would seem that post-financial crash people were, understandably, mostly concerned with the economy and this matches a desire to leave the EU shown in the first chart (as people sort to blame existing structures for a failure to protect them?). By 2015 though views on the economy had mellowed just as the economy had begun to normalise and support for the EU grew. There were no new shocks to the economy in 2015, no new immigration data or shifts in the UK. All that happened in 2015/16 was a campaign by the Brexit group and its follows in the mass media that immigration was the ‘problem’ and leaving the EU was the solution. So there you have it. While a rump of the leave supporters probably would hold that view come what may they were pushed over the finish line by a tide of anti-immigrant racism. Whilst that is not a PC thing to say it is evident in the data. It’s not austerity or the economy but successful propaganda that appealed to some people’s deep seated mistrust of foreigners that seems to have won out.

3 Comments

Since June 23 we have seen a flurry of media hyperbole linked to BREXIT as they seize on any snippet of data to show all is well, though the Olympics seems to have distracted us of late. Economics is not called the dismal science for nothing and the one thing an economist needs is patience. This is an economy on slow burn, but it is burning.

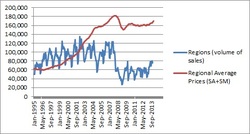

Much was said about economists inability to predict the finical crash of 2007 and this was used to imply that predictions of the economy where systemically flawed. Of course what this fails to recognise was the context of that crash. Much money had been lent to individuals and corporations that had, or should have had, poor credit ratings. This debt was then passed off as being low risk. The market requires accurate data to price and manage risk. To predict this crash one would have needed a model that factored in that much of the securitised debt was miss represented – given that it was not known that this was the case that would be a perverse model. BREXIT is quite different. Here the risks are known and can be priced in and modelled. So why did the economists get it so wrong, why aren’t we in a recession? Well I’m sorry to disappoint you, I appreciate it is comforting to think that experts are wrong and all that book learning is a waste of time, but the models were and are for BREXIT not BREXIT MAYBE. BREXIT MAYBE is happening right now. The first hit has been to the sterling. As predicted, uncannily exactly as Soros predicted, the pound hovers around $1.30. The impact of this is slow to work through but we have already seen it with fuel prices. Though the price of crude had crashed over the past couple of months, only to regain strength then fall again, the price at the pumps (after we have had to buy in dollars) has been static. Though fuel companies are often slow to pass on cuts even a fraction of the 20% cut in crude has been completely absent (my fuel today was 2p per litre dearer than June 23rd). It’s been good news for tourist coming to the UK though, and they have had a bit of a spree, but the impact on domestic consumption is a little slower to work through as stocks are run down and existing forward contracts exhausted. All the signs are that we are now entering a period of inflation that will result in a rise in the cost of living. This is directly caused by BREXIT MAYBE. There was also some talk of a reduction in investment and of course every tiny bit of news that says a company will still invest has been trumpeted as proof that everything is fine. Whilst we have seen some companies ‘not stopping doing what they had already planned to do’ we have also seen some that have pulled back and held back on investment. This has a direct link to productivity which in turn links to wages, and coupled with the inflation we now see people can expect a fall in real wages over the coming years. Not one single company has declared that due to BREXIT they will now invest – only that they are now reconsidering. Big infrastructure has taken a hit. Here the decisions are made based on long term expectations and so far the value of investment has dropped £5.8bn (https://www.theguardian.com/business/2016/aug/22/infrastructure-spending-nosedived-after-brexit-vote-figures-confirm), and investors are now expecting the Government to invest more to make up the shortfall. That’s the figure for just one month though. This fall is linked to investors’ long term expectations and that’s where a twist comes in…. We had been promised an emergency budget that would see tax rises and spending cuts but that was wrong too wasn’t it? Well not quite. A third option has been activated by the Government. If you can’t earn more and you can’t spend less you could always borrow more. Years of austerity aimed at a balanced budget have been swept aside as the Government promises to borrow more to prop up the economy, good news for the markets as someone is writing blank cheques, but long term? If debt wasn’t a problems what were all those cuts about? Which takes us to the Bank of England. The bank has cut interest rates and started printing money (again). Notice though that the cut hasn’t really been passed on to you and me? The equity markets are happy for five reasons. First they have time to restructure and relocate in an orderly fashion, remember they don’t like surprises as per the 2007 crash, secondly the BoE has started printing money, third the Government is writing blank cheques, fourth, and especially true for FTSE100, international companies earning foreign currency have seen their revenues rise in sterling equivalence just due to exchanges. Finally, and perhaps most importantly, the markets have settled down to the fact that the UK will accept some sort of Norway style membership with free movement and trade in return for a fee. They expect the British to do that British thing of being sensible after all the fuss. Settle down and be reasonable. This is the way the political narrative is going and looks to be the likely outcome, continued membership of a free trade area with free movement of people (with some sort of woolly worded sop to the rampant nationalists about emergency brakes). (Just to give a little perspective the Dow Jones is the highest it has ever been whilst the FTSE100 and 250 are yet to regain the position they were in 12 months ago). So all in all not too bad. Well not too bad for something that hasn’t happened yet. Actually that makes it pretty bad. The economy is slowing and we haven’t yet started, in fact we are at least three years off a position where we have to trade outside of full EU membership. We have no clear picture of what that may look like – though the markets expect something like Norway style deal. Investment in UK is slowing, the Government is upping its borrowing and the bank is printing money. And all of this before BREXIT – and the models were all predicting BREXIT not BREXIT MAYBE. You know that bit in a sci fi horror where the young recruit stands up and says “see it wasn’t so bad” just before an alien bites his head off? The economists are still sitting down.  As the date of the referendum draws near it seems that much of the debate around EU membership still consists of soundbites and hyperbole. On one side there are stories of lost wealth and rights and on the other immigration and sovereignty. Behind it all are some quite simple choices though and I hope to spell them out here. The first area I will explore is the economy, the reason being that trade is central to what the EU represents, that also provides a lead into legislation and immigration. These three things are inextricably linked and are the core of the debate, or should be. On the economy we are faced with two choices, we can remain and continue to grow and develop as we have over previous decades or we can exit and strike out on a new path. We are clear what remain represents but what would this leave economic path look like? Here is our first obstacle, though not insurmountable. The leave camp often totes a figure of £350m a week in savings. This has been demonstrated numerous times to be a falsehood. The UK should contribute £350m per week but instead pays around £250m due to our rebate –the remainder is covered by other EU states (https://fullfact.org/europe/our-eu-membership-fee-55-million/). So £350m cannot be saved as it is not paid. £250m is still quite a bit though – but then of course we receive a fair chunk back in the form of farm subsidies, grants, investment and other schemes. Of course exit would mean we were able to choose how we spend that money. But have the leave camp been open and honest here? I mean it is one thing to say “we could spend that on the NHS” but this is disingenuous. What would be fair to say is “by leaving the EU, ending regional grants, stopping farm subsidies and stopping investment in business we could instead spend the money on the NHS”. This also assumes that any post-exit government would be pro-NHS and anti-tax cuts and free markets (of the type favoured by the more radical elements of leave) – you cannot spend money twice nor adopt two positions. Of course all of this sets aside the debate about membership benefits. Being in the EU is much like being a businessman and joining the local golf club. The benefits from membership might have little to do with golf and a lot to do with membership. By being involved you are able to influence business deals and receive a return on your investment. It would be foolhardy to assume you have the same access and contacts if you were to stop paying. The benefits of EU membership, from an economic perspective, relate to free trade. The terms the UK has with the EU are better than any country outside of the EU. No one is saying the UK would collapse on exit (an ad hominem put about by leave), but all indicators suggest that exit would result in a reduction of GDP (with the exception of some more extreme models we will come on to). The reason for this is simple. Assuming the UK does not immediately sign up to a Norway style model of accepting all the rules, paying a fee but not being able to vote, which would be worse than we are now, we will have uncertainty and delay. Outside the EU the UK would no longer represent a way in to Europe for foreign direct investment. Those companies that use the UK as a springboard would need to relocate to other EU countries. In addition the relevance of London as a finical centre will be questioned. It will not cease simply be less relevant as THE financial capital of Europe. Add to that the uncertainty and the likely flight of capital as it seeks safe havens, the impact of less migration on labour costs, tariffs on imports etc., etc. and it all points to a decline in GDP. Of course the leave camp has a solution to this. They are not suggesting we leave and isolate ourselves. Their answer comes in two parts though. On one side you have the economists, not many, but a small number who are pro-leave. These are led by Minford (http://www.walesonline.co.uk/business/business-news/doom-gloom-forecasts-around-brexit-11071818). They have a very clear position and one that is recognised by other economists as legitimate if perhaps naive and undesirable (http://www.ft.com/cms/s/2/11ac1414-f643-11e3-902a-00144feabdc0.html#axzz471TtyKlV). They propose, as Minford has since the 80s, wide scale deregulation and free market trade. In other words their model is one of stripping away rights and rules pertaining to employment, to open up our borders to free trade and to allow a free flow of goods and investment. This free market model was too extreme for Thatcher’s government of the 80s, though it adopted some parts, and would see an end to the welfare state as we know it. The free market style of economy they propose is to the right, economically, of the rest of the EU, of the USA and of Japan. It is one were market forces decide everything. This is a perfectly valid economic position and may, only may, in fact increase GDP. Whether that increase translates to a fair distribution of wealth remains to be seen. It is certainly difficult to point to a country where this is the case. However if we trust that markets will not simply result in the rich getting richer and the poor poorer then this is a real option. The second, less radical approach, suggest that we can carry on as we are as the EU will beg us to trade with them on the same terms. That’s quite a gamble. A bit like saying to the golf club “I’m not paying my fees anymore but I am still coming”. Supporters of leave will of course point out that there is the issue of trade and that we buy more from the EU than we sell to them. This is true but is a red herring. We buy more in pounds but are small in proportion. Basically it would be like saying to the golf club “but I drink more in the bar than you pay me” (assuming you did a bit of maintenance work for them). Yes the pounds you receive are lower than the pounds you pay but compared to the overall bar takings your bar bill is very modest, too modest to grant you special rights that other club members would then demand. Almost half of what we trade is with the EU but a small percentage of what they sell comes to us (http://www.niesr.ac.uk/blog/after-brexit-how-important-would-uk-trade-be-eu#.VyHo77f2bcs). We are more desperate to sell. This does not place us in a strong negotiating position. It is all well and good to argue that we are the fifth largest economy but Germany is above us and France right beside us. To put it in perspective the US and the EU are both around six times as big and China around four times as big. Germany, the US and China do not have unbridled free access so why would we? Of course the EU would reach an agreement with us, no one is arguing otherwise, but it would not be simply “same as now but with no fees and no rules”. A model like Norway would be more likely. In this model we pay, we have to follow the exact same rules and we would have to allow free flow of labour (migration) (http://www.telegraph.co.uk/news/uknews/immigration/11190269/If-EU-migration-is-the-problem-Switzerland-and-Norway-are-not-the-answer.html). The worry is that no one from the leave campaign seems to have spelt out or tried to negotiate what this model will be or looks like, with the exception of Minford and the unbridled free trade movement. Representing the supply side of the economics debate is legislation. There is a lot talked about ‘laws and rules from Brussels’ but people seem to find it hard to point to one they dislike. In part this is because most EU related legislation does not impact on our daily lives (like the way crisps have to say ‘beef flavour’ as they contain no beef). It’s worth remembering that the EU is a diverse area in terms of law. In some countries abortion is illegal while in others prostitution is legal. In some you can smoke pot while in others you cannot smoke cigarettes in public places. Much of the legislation relating to the EU is simply trade regulation. These rules are similar to the rules found in a sporting event. If you want to play the game you have to follow the rules. China, the US and all other countries have to follow EU rules to trade in the EU and yet have no vote. Outside of the EU we would still have to obey them when we traded and our compliance would form part of any negotiation. Minford and crew are clear though on which laws they would scrap – these mostly relate to workers rights and consumer protection (supply side constraints). The less radical elements in the leave camp are more coy. Finally we come to migration. Free movement of people is an essential element of free trade. Labour and lemonade are no different in that respect. The UK has control of its borders, it is not part of Schengen, but it is true that if a Polish person wants to come to the UK to work, or a British citizen wishes to work in Paris they are free to do so. Benefits are a different matter and there is no automatic right to them (http://www.bbc.co.uk/news/world-europe-25134521). Of course if the benefits policy is not firm enough the UK Government is free to tighten it. A government simply has to treat all people equally – there is no requirement for it to be generous. We have a little more control on immigration being outside of Schengen, as anyone travelling in and out if the UK will notice. On a recent trip to Britany I was intrigued that I drove on to the Eurostar at Folkestone and drove off and on to the motorway at Calais with just a friendly wave. On the return though I was stopped, passports and names were checked, and it felt much more like ‘returning from abroad’. People’s concerns about immigration have been fanned by various vested interests. The evidence is clear that EU migration makes a positive impact on the UK economy – they give more than they take (https://www.ucl.ac.uk/news/news-articles/1114/051114-economic-impact-EU-immigration). With unemployment at a record low (http://www.bbc.co.uk/news/business-35594650) it is hard to see how employment would be positively affected by a reduction in immigration. It is true that a more constricted labour market would see wages rise. Less people going for the same number of jobs will push up wages but at the same time it will reduce productivity and drive inflation. Minford again has solutions for this – strip away workers’ rights etc. but the leave campaign do not provide much more by way of analysis. In addition the Norwegian model requires us to allow migration in its present form; in fact Norway, Switzerland and Iceland are all members of Schengen. The economy is benefiting positively from the present situation and so it is hard to see on what grounds, other than a petty form of racism, people would wish to restrict migration? The remain camp have certainly thrown some startling figures around and this could be described as a campaign based on fear, but it is hard to see how else the argument can be made. The leave camp has provided, Minford the exception, no model of how the UK will function. This vacuum has to be filled by data from the remain group and inevitably that does not paint leave in a good light. If the leave camp were open and honest about their model, assuming they follow Minford, or were clear about their preferred choice (Norway ‘with a, b and c’ changed for example) there could be a debate. Instead leave simply seem to produce a string of soundbites and clichés. The remain message seems clear: remain, influence, grow, develop, shape. Leave is far harder to call; on the one had insular and protectionist (British this for British that) and on the other rampant Minfordian free trade with open borders, unrestricted trade and imports and few workers’ rights. edit.  Now I am back from Normandy I am trying to catch up with the comments and blogs. What seems to have emerged is a debate about definitions (mostly around enterprise/entrepreneur), a collection of anecdotal evidence and some PR. In many respects this represents the area rather well. I’m reminded of the French commander’s observation of the ill-fated Charge of the Light Brigade “C’est magnifique, mais ce n’est pas la guerre" ("It is magnificent, but it is not war"). I fear with us, though thankfully far less disastrous, it is more “it is great but it is not business”. It is really interesting to debate the difference between enterprise and entrepreneurial activity and this has rolled on. I’m happy that we have some blurring and in fact I often start with a venn diagram with students trying to pick out what is uniquely enterprising, entrepreneurial, employable (employability). It’s hard. Normally we (not i) conclude that the entrepreneur is the one that manages more risk and has more of the pushy individualism. But I don’t want to get too bogged down in that debate. Where I see employability, and I agree with Dave fully here regarding its flaws, is enterprising employability. The graduate training schemes are clone machines often and poorly equipping us for the challenges of the future. I guess I’m saying I think we should merge employability and enterprise – taking the best of enterprise with us and shaking up employability. Drop the distinction that sees enterprise equated with self-employment (rightly or wrongly) and allow it instead to be linked innovation and creativity in any workplace. With regards business start-up we can easily over-intellectualise this. Let’s face it the vast majority of businesses are run by people with Level 3 skills (on the scale that sees HE as 4-6). My dad was one as was I before I came back to education. Basic bookkeeping, a bit of law and some marketing are all that is required and can be taught in a week or less. That’s all good and all healthy. Keep it simple, make money. Where are we trying to push graduates though? I would hope to be contributors in a prosperous economy at levels way beyond Level 3. I hope they found and run multi-million pound business or at least help someone else grow theirs. The skills needed though are not well served by cupcakes. With regards surfing I’m afraid the beach bit is just surf schools being enterprising and padding out the lessons for tourists. In a way that’s perhaps another analogy for what we often do in enterprise education. Locals tend to learn by grabbing a board and heading straight in.  I still don’t want a cup cake. Not having had a blog written in response to a blog before I was intrigued by Dave Jarman’s last week. You’ll need to read mine below and then Dave’s to see the context. Or accept that it’s a debate about the direction enterprise education is heading with me as the heretic. You are correct to take my blogs at face value. I write them as a sort of stream of consciousness and free from the editing and the rigours of my daily life. I like the form. I like Jack Kerouac but lack the ability and intellect. Probably best if I try to pick up your points in order though. If we are going to call it enterprise then it must be enterprise. Enterprise is that spark that turns the other factors of production into a more effective return and we have to make a return. And then we have to be taxed. That’s ok and that can work. But let’s not bog that down with crony capitalism. Let’s not mix up twisted markets with innovation. Wealth through innovation and sound management should be our goal but too much of our system is still a mix of ‘old boys’ and robber barons. That’s feudalism not enterprise. The issue you raise goes to the heart of the problem of enterprise education though. It feels, looks and tastes at times as if much of the agenda, especially outside of the business schools, is distinctly and ironically anti-business. It’s as if we are trying to lead a campaign that says that business is not about money, as if that is our core purpose, not so much apologists for business but champions of ‘another way’. We shouldn’t be either. The trouble is, and going back to the first part of my first blog, we are shoehorning everything into enterprise education. We don’t need to. Instead we need to push employability; we need approach that to develop opportunity ready graduates not to twist and distort enterprise to be a one size fits all. In fact if we were talking about employability education then much of what we do in so-called enterprise fits and sits comfortably. By separating the two, by talking as if enterprise was something ‘other’ and then by reading the same script as we would for employability we lose credibility. If we have diluted the idea to an extent were all can self-define, where all must have prizes and everyone is enterprising then we really have lost the plot. With regard risk it is clear that simulated risk is not risk, simulated cream is an abomination. I have spent a life time surfing and whilst it is true that starting on smaller waves and building up is the only way to go you can still drown. In fact you are at as much risk on the smaller waves with no experience as you are later when your experience is pitted against monsters. De-risking is a business skill but risk has to be there to then be mitigated. The idea of designing enterprise education such that risk is removed, reduced or simulated for individuals not ready would be like running surf lessons for people who can’t swim. That’s the point to simply say come back when you are ready; maybe spend some more time on the employability courses until you gain confidence. But when you are here they will chew you up and spit you out – that’s what it’s like out there. Of course students’ products will always be sympathy products until and unless they stop telling people they are students. There is no need for exercises just get them selling or dealing and making things happen without ever saying you are a student. I appreciate people will say “ah well it’s enterprising of them to play on the fact that they are students to get sales” and this is true and part of the paradox, but it’s not real. It’s as fake as travelling around with a TV crew and dropping Lord Sugars’ name every five minutes. The idea of ignoring costs really does mirror society. We see many businesses ask about grant availability, about discounted rent and about subsidies. Of course we train students to do the same. It’s not that these things shouldn’t be sought; it’s not that people should take advantage of offers but rather when we judge a (student) business to be a success we fall in to the old trap of revenue vanity and allow them to do the same. The whole idea of enterprise education has become wonderfully inclusive. The thing is inclusion should be on blindness to race, religion, gender and sexuality not ability, skills and attitude. Business does that, in its raw market form, rather well. There’s something fundamentally wrong with enterprise education (‘why I don’t want another cupcake’)7/23/2014  This is just going to be a short blog, I’m just marshalling some thoughts for a paper, but there’s something fundamentally wrong with enterprise education. I guess if we start by unpicking the muddle that is purpose we will see part of the problem. Is enterprise education like a Duke of Edinburgh for kids who don’t like going outside? You know sort of all about teams, self-discovery and working together and helping the community to make you a better person? Or is it about developing skills for the workplace, in addition to those teamey ones? Or is it about running a business? Or maybe about being entrepreneurial. “It’s all of them” I can almost hear the managerial classes shriek in delight as it ticks the equivalent of a rainbow of targets in one sweep. “That’s the brilliant thing about it. It covers everything and more”. I have to disagree, not because it doesn’t cover these things, but because it does, albeit in a limp way. It does when business actually doesn’t. Business, market based business, red in tooth and claw is a million miles away from the sanitised exercises we see students engaging in. The first sort of rule of free market business, ok not the first but the first relevant one, is moral hazard. If you start a business and you get it wrong you lose. You lose enough to really sharpen your senses and make you focus. Maybe it’s not capital but your credit rating– either way there is risk associated with any return. Of course we don’t see this in the classroom, not only do students not risk their own money they don’t even risk grade. Fundamentally this is not free market business. The second rule of business, above caveats on order notwithstanding, is that you must provide what the market wants. It would seem the market wants cupcakes, more and more cupcakes. Cupcakes and various other confectionaries. Not that I can’t easily obtain these from my nearest bakery or supermarket, not when I can purchase an inferior quality one at an inflated price from a, heaven forbid, social enterprise. You see we send students out to sell to the great and the good as students not as businesses. These are not market based purchases but sympathy purchases. Sympathy purchases mess up markets. Utility goes out of the window and we pay over the odds because it’s a nice thing to do. So now we have no risk businesses selling sympathy products. Third on my list, I was going to say our list but that’s a little presumptuous, is costs. Four students working on their business for six weeks, putting in a day a week, manage to generate £1,000 profit. Well done. Less than you could have earned working for 24 days equivalent at minimum wage of course, but well done. Of course you have used the organisation’s public liability insurance as an umbrella and managed not to have to pay advertising or rent as these also form part of that umbrella but let’s not be picky. If we were picky and rigorously applied a hypothetical charge, like we would in making an investment decision, of course profit would shrink o something far, far less than minimum wage but that’s all rather theoretical isn’t it. We aren’t teaching enterprise what we are teaching is a funny eclectic set of nice things. We have badged it as enterprise but it’s not the sort of enterprise that generates GDP growth or wealth. Until we get straight what we are trying to achieve we will remain in this mire, failing students by passing them.  The vexed issue of taxes part two……… Ok so we saw below (blog) why we may need to pay taxes the question now becomes how we pay them. Basically there is no free lunch – someway in some form you are going to pay a tax. Income tax is the obvious one, the value added tax is fairly clear, national insurance and car road fund are types of taxes too so there are a few for a start – even if you don’t work they’ll get you. We could always load it on corporation tax instead – after all they have lots of money. But then if we do that it will impact on prices. Companies are not able to run at a loss and so company tax becomes just another business expense. Of course we can conclude that the Government is on the make– after all why have I paid my car tax for such rubbish roads, why do the government expect me to fund my health care when I pay NI? Here’s the problem, we don’t pay enough…. NI take - £110 billion – £289 billion cost of pensions and NHS Car tax, tax on fuel -£5.9billion and £26 billion - £23billionspend on transport So the we haven’t paid anything like enough for health and pensions but we have paid a bit too much for roads, especially as transport includes non-road transport. Or have we? Of course non-road transport (trains) eases pressure on the roads, in addition ‘transport’ does not include policing nor does it include spend at a local level by councils. So maybe we could ease tax on fuel back by £9 billion but then which other tax will we put up to cover this and what impact will that have on car use – people won’t drive less as a result! Thinking about tax and fairness it always seems a little strange to tax someone on effort. Income tax is problematic as it taxes work. Income tax also makes up our biggest tax revenue at £167 billion. That said many people don’t pay it – after all the tax threshold is£10,000 and after that you pay 20% until you get into the 30s. But actually it’s not quite that simple. If you have a couple of children and earn£20,000 the Government give you back about £4,000 – which is more than 20% on the £10,000 you have earned. So income tax is, contrary to popular belief, mostly paid by the wealthy. It still seem a little perverse to tax people on effort but at least the present approach taxes proportionally higher based on ability to pay. The third biggest tax is National Insurance. As we have seen above this doesn’t cover what it was set out to pay for but provides a useful income. Again it charges proportionally more for those earning more. Sat between these two is VAT. VAT seems fair, tax on spend not on effort. Of course there are anomalies such as the VAT on health and hygiene products but overall it seems a fair tax. Perhaps an answer is to lower income tax and increase VAT? An increase in VAT to 25% would in theory raise over £20 billion and that could crudely see a 20% drop in income tax (from 20% to 18% not unfortunately from 20% to 0%). The only trouble with this is those on a zero income would see cost rise but income remain static. Pension and benefits would have to increase to cover this shortfall. Once cars are stripped out of excise duties the remainder is quite modest and let’s face it the drunks and smokers clogging up the NHS and the courts outweighsthe amount collected in revenue. Corporation tax and business rates together add up to £68billion. In many ways it is hard to see how this could be increased. Any increase is likely to be passed on in the form of higher prices and so we may as well collect that money directly via VAT. Inheritance tax is a funny one. It’s very low and only applies above £325,000. The thing is most of this relates to increases in the value of houses. It is not earned but a happenstance of owning property, property that you wouldhave paid less than £50,000 in the early 80s now worth over the inheritance tax threshold. Of course even with interest you would have paid nothing like this amount. So why don’t we lose the threshold and simply charge a flat 20% on all estates. We only raise about £3billionthough inheritance at the moment but this could rise significantly with a new threshold and rates. In addition it has the advantage of stimulating the housing market by encouraging sales to fund the tax bill whilst not reducing anyone’s incentive to work. What we see of course, just as with spending, is that taxation is necessary but over complicated. We take income tax from the low paid and give back more in the form of credits. We strip the NHS of cash and then expect enhanced services – when we haven’t even paid for the ones we get. We complain about poor infrastructure but want to pay less tax in order to improve it. Overall we simply want someone else to pay….  The vexed issue of taxation…… People always like to complain about taxes, public spending and growth and so I thought it would be fun to start from scratch and build up a system in a naive copy of Plato’s Republic. If we make certain assumptions such as people’s desire for economic wellbeing and growth and a desire to live in a fair and just society we can try to work through what might make up a tax system. Why taxes? Well taxes are used to take care of market failures – things that aren’t provided for a by a market mechanism. There is no need to subsidise soft drinks firms and phone companies as people will happily pay for these and it is easy to see ownership and control. Streetlights, on the other hand, cause us the problem that ‘pay-as-you-go’ would see towns in darkness and Pied Piper like lines following the one sap who is paying. Looking back in history we see that kings raised taxes to pay for armies and to build palaces. We can forget the second one and the first shouldn’t be an end in itself. What we really need first of all is a way for us to do business. We need some way of being able to enforce contracts and secure legal title. In the absence of this business will not flourish. So sort form of judiciary is equired and that needs to be freely accessible and independent – so we need to cover that with a tax and a bit of central dministration too. Ok so now we can do business and get paid, we really could do with infrastructure. We could build toll roads and perhaps we should, though that does restrict the movement of people and goods somewhat. Probably best the state builds and maintains roads. Electricity and water are also required and these can be either state or private. Either way though we pay to use so no tax is required there. Ok so we have a country that has enforceable contracts and infrastructure. We haven’t forgotten the army – some sort of defence force needs to be added and that will require more tax. To ensure we have an effective and efficient workforce we will need education – most people won’t be able to pay for that and so again we will need to raise some taxation. Ideally this education will extend to as high a level as required but should at least secure literacy and numeracy to adult levels. Of course we need to help people manage their health – we need to ensure vaccines are used and communicable diseases are managed and reduced. Again people may not be able to pay for this – and certainly we don’t want to leave it to chance so some form of health care provision is needed. We can’t do business with ourselves though so need to fund embassies and aid overseas to increase our customer base and influence. Some of this can be privately funded but we probably need some state intervention. In summary we have a judiciary (to include police), infrastructure, defence, education, health and foreign affairs. People do get old though and probably won’t have saved enough so some sort of basic pension is required, alongside some sort of fiscal help for those unable to work due to health. Should this utopia not provide enough work then there needs to be some subsistence allowance for those not working. So what do we do in reality? 20% Pensions 19% Health 13% Education 10% Other benefits (inc. tax credits) 7% Debt Interest 7% Culture, sport etc. 5% Defence 4% Public Order 4% Personal Social 3% Housing & env 3% Transport 2% Dept for Business Most of our money is spent on paying pensioners. There are lots of them of course and so that’s a big bill. We spend a fair bit on health too – though we have one of the lowest spends per head in the developed world (we are 15th). With education we are 17th –though we have very crammed classroomsso that may help explain that. We spend a lot on tax credits, subsidising low paying companies – about 10% of the total. Then of course a big chunk goes to private landlords in the form of housing benefit. Paying for the banking crisis is our next big spend followed by sport and culture. Defence is relatively cheap and policing even cheaper. Infrastructure and business are last of all. Let’s take a step back though and ask again why. For example £53 billion doesn’t need to be spent on sport and culture – they are not market failures. The FA is wealthy beyond the dream of avarice after all. Numerous billions could be trimmed from pensions if people had paid in to their own schemes. Housing benefit could be reduced if the housing market was freed to operate properly and councils freed to build. Health is a tricky one – we don’t pay that much by international standards. Perhaps though efficiencies can be made centralising and reducing the number of local GPs? All in all though the tax system doesn’t seem that mad – at least on the spending side. Perhaps we should look again at the tax raising side though?  A housing market in crisis With my background in construction I have always kept an interest in property, it’s my natural home if you’ll pardon the pun. What’s troubled me as an economist is the nature of this market, particularly in the last few years. Whilst it’s common knowledge that the market is strained – and by market I mean the free markets ability to provide houses for those that need them – until I looked at the data I was unaware just how bizarre it had become. A basic bit of economics tells us that more demand pushes prices up, more supply brings them down. If there’s shortage of houses then the answer is to build more. Simple enough. The demand bit can be modified too of course. A recession should dry up money a little and perhaps see a fall in demand and a reduction in price (unless the product/commodity is being used as a safe haven in the way gold is). This is all simple enough. So let’s look at the data (care of http://www.landregistry.gov.uk/public/information/public-data/hpi-background): In this first chart we can see that as activity grew from 1995 – 2007 so did prices. More purchases took place and prices rose. Prices started doing something interesting around 2003 onward – they started accelerating away from volumes. This would suggest demand was starting to outstrip supply. Bang. 2007 and everything drops. Well volumes drop a lot, prices only marginally. Then something strange happens – volumes hardly recover at all but prices do. We have a situation where there is less activity, markedly so, but restored prices. Why have the Government targeted demand and not supply in what seems to be an inelastic market? Why have they allowed cheap lending and help to buy and yet done little to help the supply side? Where are the reductions in red tape, liberations to planning restrictions and other positive measures that would boost supply and control prices? There is no correlation between volume and price - pretty much none at all as this chart shows. Somehow money has become available and is chasing the few properties on the market. This is a price recovery fuelled by demand only. This would be ok if not for the fact that the wider economy is quite quiet – in other words this is a price recovery fuelled only by debt and credit – and I think we have been here before……

Russell Brand half term report

So much chat about this interview I felt it would be fun to review it as if it was a viva for coursework and provide some feedback for this student. I won’t cover every interaction but will try and pull out the ‘gems’. (transcript from http://www.broadsheet.ie/2013/10/24/viva-brandanista/#comment-767958) Paxman: “Well how do you have any authority to talk about politics then?” Brand: “Well I don’t get my authority from this pre-existing paradigm which is quite narrow and only serves a few people. I look elsewhere, for alternatives, that might be of service to humanity. Alternate means; alternate political systems.” Jeremy is asking why we should listen to the views of someone who does not vote when it comes to politics. Given that the OED, and I promise I won’t use too many OED definitions, defines politics as “the activities associated with the governance of a country or area, especially the debate between parties having power” and given that you have been the guest editor of the New Statesman, a left leaning British political journal, the context for this interview was the discussion of politics in the democracy that is Britain. As a non-voter you had never participated in that process of governance though would have felt its effect. You have now of course opened yourself up to questions as to what is meant by alternative paradigms and systems. If you had not wanted to discuss these a more concise answer may have been “as a citizen of Britain I feel the impact of political decisions even though I don’t vote, and voting is not mandatory”. This would have led to a question relating to why you don’t vote, to which you could have opened a debate about feeling that it is ineffectual. This would have been preferable to opening a debate on paradigms but then refusing to be drawn on them. Paxman:“They being?” Brand:“Well I’ve not invented it yet, Jeremy. I had to do a magazine last week. I’ve had a lot on me plate. But I say, but here’s the thing that you shouldn’t do. Shouldn’t destroy the planet, shouldn’t create massive economic disparity, shouldn’t ignore the needs of the people. The burden of proof is on the people with the power, not people, like, doing a magazine for a novelty.” Now Jeremy has asked you a quite legitimate question based on your previous statement. Your points relating to the environment and economic disparity are tautological, no political system sets out to destroy the environment and no democratic system sets out to create disparity of income. By definition democracy is rule of the people so one that ignores the people is meaningless, unless of course they don’t vote, then there is no mechanism by which they can have their needs communicated. Of course there are different variants of democracy, from first past the post to more proportional methods, but you have not alluded to these. Your use of the word ‘novelty’ has allowed the audience to believe your views are trivial, a point that you are aware comes back to haunt you. Perhaps an alternative response wold have been, and this is difficult as you have already set yourself up as being in possession of knowledge of an alternative paradigm, “I would prefer a more representative type of democracy”, this assuming you wish to see a democracy maintained. Paxman: “How do you imagine that people get power?” Brand: “Well I imagine there are sort of hierarchical systems that have been preserved through generations…” Paxman:“They get power by being voted in, that’s how they get power…” Brand:“Well you say that Jeremy…” Although there is some evidence of a disproportionate representation from public schools within parliament you need to cite facts not sweeping generalisations (this site provides data http://www.parliament.uk/business/publications/research/key-issues-for-the-new-parliament/the-new-parliament/characteristics-of-the-new-house-of-commons/). In addition you fail to pick up throughout the interview the lack of female representation; this bias is something I have noted elsewhere in your work and something we should discuss. Although 90% of MPs are university graduates given the nature of this work that may not be surprising. Granted 25% went to Oxford and Cambridge and this is disproportionately high as is the number who attended fee paying schools (and it would be interesting to see if these two are linked). However only 30% went to such schools compared to 10% in the wider population, this hardly represents a majority. You fail to answer the question and seem to struggle at this point; again having access to facts may have allowed you to present your case better, though it would be one of representation rather than the conspiracy angle you seem to be opening up. Paxman: “You can’t even be arsed to vote?” Brand: “It’s quite a narrow, quite a narrow prescriptive parameter that changes within in…” Paxman: “In a democracy that’s how it works.” Brand: “Well I don’t think it’s working very well, Jeremy. Given that the planet is being destroyed, given that there is economic disparity of a huge degree. What are you saying? There’s no alternative? There’s no alternative? Just this system?” Having failed to address the voting issue earlier you have opened yourself up to additional questions. In future ensure you close points off. You seem to panic and return to tautology. Jeremy has not said there is no alternative he has asked you why you do not vote. Try to listen more closely to the question and address it. Paxman: “No, I’m not saying that. I’m saying if you can’t be arsed to vote why should we be asked to listen to your political point of view?” Brand: “You don’t have to listen to my political point of view. But it’s not that I’m not voting out of apathy. I’m not voting out of absolute indifference and weariness and exhaustion from the lies, treachery, deceit of the political class, that has been going on for generations now. And which has now reached fever pitch where you have a disenfranchised, disillusioned, despondent underclass that are not being represented by that political system, so voting for it is tacit complicity with that system and that’s not something I’m offering up.” You have forced Jeremy to repeat the question as you have failed to address it, this is not good practice. Your first point could have opened up a question relating to free speech and your right to hold an alternative view but you fail to capitalise on this and instead now choose to answer the voting question which should have been covered at the start. However you have introduced a timeline. As a 38 year old you have had numerous opportunities to vote over a 20 year period. Are you saying it is worse now than in 1993? In truth turnout has dipped, from 77.7% in 1992, but is now returning rising to 65.1% in 2010 (http://www.ukpolitical.info/Turnout45.htm). In addition you do not explain how voting represents complicity. There are a multitude of parties to choose from in addition to the more famous ‘main’ parties. Any of these would represent a signal and they range from green to nationalist. Paxman: “So you struck an attitude, what, before the age of 18?” Brand:“Well I was busy being a drug addict at that point, because I come from the kind of social conditions that are exacerbated by an indifferent system that, really, just administrates for large corporations and ignores the population that it was voted in to serve.” Paxman: “You’re blaming the political class for the fact that you had a drug problem?” You quickly address this point in the following reply and it is clear you are aware of the folly of linking society to your drug problems. Your troubled past is one that society may have been better able to assist but from you next comment it is clear you appreciate the link is not directly causal. Paxman: “Of course it doesn’t work for them if they didn’t bother to vote.” Brand: “Jeremy, my darling, I’m not saying…the apathy doesn’t come from us, the people. The apathy comes from the politicians. They are apathetic to our needs, they’re only interested in servicing the needs of corporations. Look at..ain’t the Tories going to court, taking the EU to court, because they’re trying to curtail bank bonuses? Isn’t that what’s happening at the moment in our country? It is, innit?” Returning to the question of representation you have again suggested some conspiracy. The link between EU law, UK law and bank bonuses is not necessarily a conspiracy though. The government regularly exercises its ability to set legislation and rules separate to the EU as part of its democratic right. The point being made by the Government is that curtailing bonuses will see bank wages increase in response meaning pay is less performance related. There are many arguments for and against this, but you are not clearly expressing why you think it is a breakdown in democracy. I would imagine you would want the Government to intervene if some form of media pay cap was suggested by the EU? Try to find stronger arguments. There are over 2million people employed in the financial services sector and they would argue that the Government should campaign on their behalf. Paxman: “You don’t believe in democracy. You want a revolution don’t you?” Brand:“The planet is being destroyed, we are creating an underclass, we’re exploiting poor people all over the world and the genuine, legitimate problems of the people are not being addressed by our political class.” This is where you perhaps make your biggest mistake. Presented with these two clear questions you choose to hide behind more tautology. Actually poverty has reduced worldwide over the last 20 years and whilst there is still an awful lot of work to do the trends are positive (http://www.economist.com/blogs/economist-explains/2013/06/economist-explains-0). By not answering the direct question you appear to be anti-democratic, which as already mentioned means rule by the people, and again you appear pro-revolution. Paxman: “What’s the scheme, that’s all I’m asking. What’s the scheme? You talked vaguely about a revolution, what is it?” Brand: “I think a socialist egalitarian system, based on the massive redistribution of wealth, heavy taxation of corporations and massive responsibility for energy companies and any companies exploiting the environment…I think the very concept of profit should be hugely reduced. David Cameron said profit isn’t a dirty word, I say profit is a filthy word. Because wherever there is profit there is also deficit. And this system currently doesn’t address these ideas. And so why would anyone vote for it? Why would anyone be interested in it?” You appreciate people will find this hard to swallow. Given your own personal wealth of $15million people may be incredulous that you somehow find profit to be a ‘filthy word’? Do you see yourself as a corporation or is your own wealth simply a private matter? A corporation uses its profits to generate additional investment in order to expand its operations. In your socialist system, and by the way these have been tried and do not represent a new paradigm – find some time to do additional reading please (perhaps start with Orwell’s Animal Farm), how will investments and innovation be made? There is a reason we have such high standards of living compared to the old USSR and it is linked to the encouragement in innovation created by competition – how will you address this? Paxman: “Who would levy these taxes?” Brand: “I think there needs to be a centralised administrative system but built on…” Paxman: “A government?” Brand: “Yes, well, maybe call it something else. Call them like the Admin Bods so they don’t get ahead of themselves.” Paxman: “And how would they be chosen?” Brand:“Jeremy, don’t ask me to sit here in an interview with you, in a bloody hotel room and devise a global, utopian system. I’m merely pointing out that the current…” Clearly now you are struggling as you have not thought through your position. Either there will be a representative democracy of some form or there will be a totalitarian government (dictatorship, feudal, etc). Paxman: “The current system is not engaging with all sorts of problems, yes. And they feel apathetic, really apathetic. But if they were to take you seriously, and not to vote…” Brand: “Yeah, they shouldn’t vote, that’s what I’m thinking they should do, don’t bother voting. Because when it reaches..there’s a point…You see these little valves, these sort of cosy little valves of recycling and and you know like turns up somewhere, it starts reaching the point where you think ‘oh this is enough now. Stop voting. Stop pretending. Wake up. Be in reality now. Time to be in reality now’. Why vote? We know it’s not going to make any difference? We know that already?” Here Jeremy is giving you another chance to think again about the importance of actively participating and you seem confused? You need to think through your answers more. What are these valves? Are you now saying that by recycling we are also being complicit and that we should stop recycling too? It is after all a tool used by the powers that be to control us? You are struggling here to make your point and have begun to rant. It is ok to take a breath, ask Jeremy to rephrase his question and gather your thoughts. Don’t feel the need to answer immediately. Brand: “Yeah, sometimes, Jeremy. So listen. So let’s approach this optimistically. You’ve spent your whole career berating and haranguing politicians. And then when someone like me, a comedian, goes‘they’re all worthless, what’s the point in engaging with any of them’, you sort of have a go at me because I’m not poor anymore.” Paxman:“I’m not having a go at you about that. I’m just asking why we should take you seriously when you’re so unspecific…” Jeremy has you well and truly on the ropes here. He has made no comment about your wealth; he also has dedicated a career to holding politicians to account. You have challenged him on two unwinnable points to deflect attention from the weakness of your own position – this allows Jeremy to challenge you on the absence of any specifics to what is increasingly becoming a rant. Paxman:“Is it possible that, as human beings, they’re simply overwhelmed by the scale of the problem?” Brand: “Not really, well possibly. It might be that, but that’s all just semantics really, whether they’re overwhelmed by it or tacitly maintaining it because of habitual…I mean like, mate, this is what I noticed when I was in that Houses of Parliament. It’s decorated exactly the same as Eton, is decorated exactly the same as Oxford. So a certain type of people goes in there and thinks ‘this makes me nervous’ and then another type of people go in there and go ‘this is how it should be’. And I think that’s got to change now. We can no longer have erroneous, duplicitous systems held in place unless it’s for the serve…only systems that serve the planet and serve the population of the planet can be allowed to survive. Not ones that serve elites, be they political or corporate elites and this is what’s currently happening.” Paxman: “You don’t really believe that.” Brand:“I completely believe it. Don’t look at me all weary, like you’re at a fireside with your pipe and your beard.” Struggling for words here you at first agree with Jeremy and then try to set up an argument on the differences between ‘overwhelmed’ and ‘tacitly’ – to be overwhelmed is not necessarily to support. As for the dive into architecture many buildings are decorated in a gothic revival style. Most people have experienced this in many of our civic buildings from that period and in fact parliament arguably seems somewhat quaint. Jeremy at this point has become weary possibly by your lack of specification and meandering. This is a cue for you to improve your presentation not a chance to insult your interviewer. Paxman: “Because by the time somebody comes along you might think it worth voting for, it may be too late.” Brand: “I don’t think so because the time is now, this movement is already occurring, it’s happening everywhere, we’re in a time where communication is instantaneous and there are communities all over the world. The Occupy movement made a difference in even if, only in that, it introduced, to the popular public lexicon, the idea of the 1% versus the 99%. People for the first time in a generation are aware of massive, corporate and economic exploitation. These things are not nonsense. And these subjects are not being addressed. No one is doing anything about tax havens, no one is doing anything about their political affiliations and financial affiliations of the Conservative Party, so until people start addressing things that are actually real, why wouldn’t I be facetious, why would I take it seriously? Why would I encourage a constituency of young people that are absolutely indifferent to vote? Why would we? Aren’t you bored? Aren’t you more bored than anyone? Ain’t you been talking to them year after year, listening to their lies, their nonsense. Then it’s this one that gets in, then it’s that one gets in but the problem continues. Why are we going to continue to contribute to this facade?” Of course on reflection you probably now realize how much this sounds like a flower power speech from the late 60s. I assume your hedonistic lifestyle has meant that you have little time for current affairs and as such have been unaware of the on-going debate and coverage of everything from sustainable communities to social enterprise and renewable energy. You need to ensure the arguments you are putting forward are contemporary. No one is suggesting the issues have been resolved but at the same time there is nothing new in what you say, in fact it appears dated. Paxman: “I’m surprised you can be facetious when you’re that angry about it.” Brand: “Yeah, I am angry, I am angry. Because for me it’s real, because for me it’s not just some peripheral thing that I just turn up to once in a while to a church féte for. For me, this is what I come from. This is what I care about.” Paxman: “Do you see any hope?” Brand: “Remember that…yeah, totally, there’s gonna be a revolution. It’s totally going to happen. I ain’t got a flicker of doubt, this is the end. This is time to wake up. Finally you make the fatal mistake of presenting yourself as one of the people. As a multimillionaire this is not ‘real’ for you in the way it may be for a person on or below the poverty line. Whilst you could dedicate time, resources and energy to exploring this topic you have, by your own admission, just been here “have a little bit of a laugh”. |

Dr Bryan Mills"There he goes. One of God's own prototypes. Some kind of high powered mutant never even considered for mass production. Too weird to live, and too rare to die" Hunter S Thompson describing the author in 1971. Archives

November 2016

Categories |